Overview:

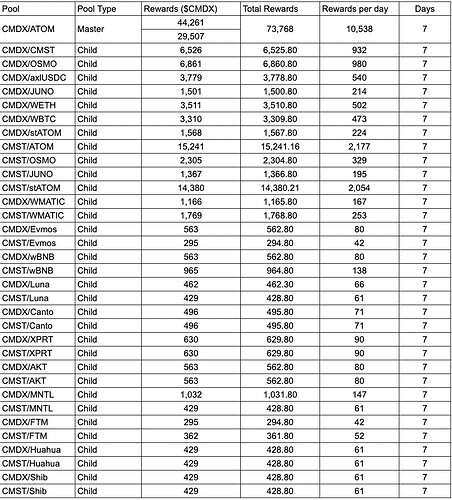

cSwap DEX has been launched on the Mainnet. With strong frameworks, good mechanisms, and a robust build, a good but healthy incentive system is imperative for the growth of the DEX. Keeping this in mind, we open the discussion to the community on an upcoming proposal to start the next phase of liquidity incentives on cSwap DEX by allocating 147,535 CMDX for 7 days - to be distributed as per the model for Liquidity rewards. These rewards will start when the current reward phase ends.

The weighting of this week’s rewards is based on pool liquidity.

This week four new pools of Huahua and Shib paired with CMDX and CMST will be added.

The Master pool will receive around 50% of the total incentives allocated for the phase. The other 50% will be distributed equally amongst the Child pools as external incentives. A detailed breakdown of these incentives is in the table at the end of the discussion.

Let’s have a quick look at the rewards mechanism before proceeding further:

There are two types of pools on cSwap DEX: Master Pool and Child Pool. Master Pool would be used on cSwap and other apps as a prerequisite for earning token incentives.

cSwap has two incentive distribution parameters; the ‘Master Pool/Child Pool Rewards System’ mechanism and the ‘External Incentives’ mechanism.

There are multiple combinations for the rewards mechanics. Still, in a nutshell, any liquidity provider will earn maximum rewards only if they provide liquidity in both the master pool and one or more of the child pools. A better understanding of the reward mechanism can be gained from cSwap docs.

The pools incentivized for the next phase will be:

- CMDX/ATOM

- CMDX/CMST

- CMDX/OSMO

- CMDX/axlUSDC

- CMDX/JUNO

- CMDX/WETH

- CMDX/WBTC

- CMDX/stATOM

- CMST/ATOM

- CMST/OSMO

- CMST/JUNO

- CMST/stATOM

- CMDX/MATIC

- CMST/MATIC

- CMDX/Evmos

- CMST/Evmos

- CMDX/wBNB

- CMST/wBNB

- CMDX/Luna

- CMST/Luna

- CMDX/Canto

- CMST/Canto

- CMDX/XPRT

- CMST/XPRT

- CMDX/AKT

- CMST/AKT

- CMDX/MNTL

- CMST/MNTL

- CMDX/FTM

- CMST/FTM

- CMDX/Huahua

- CMST/Huahua

- CMDX/Shib

- CMST/Shib

The breakup of rewards for each pool is as follows:

Note: Rewards are in $CMDX

We intend to run the incentives until the protocol matures. Post maturity, these incentives will be optimized again after discussion with the community.