Important Update:

Transitioning to a new framework, all pools will now be receiving base CMDX rewards, with CMDX pairs being given priority. CMDX rewards on CMST pools will be reduced as they start receiving Harbor emissions this week. You can learn more about Harbor emissions through the link provided, and check this week’s Harbor emissions at https://app.harborprotocol.one/

cSwap v2 Announcement:

We’re thrilled to announce the launch of cSwap v2 on the Mainnet. To facilitate the robust growth of the DEX, we’re proposing an optimized incentive plan to align with our users’ needs.

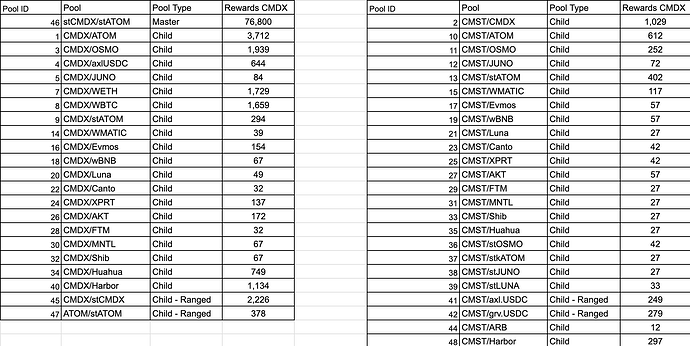

Our revised plan proposes allocating 96,000 CMDX for an extended period of 14 days – a departure from the previous 7-day epoch.

The distribution of these rewards will commence once the current reward phase concludes. CMST pools will receive Harbor emissions. Users can stake and vote with their veHarbor to receive emissions to their pools.

In response to feedback that the Master/Child pool concept was difficult to grasp, we’ve adopted a simplified ‘boosted pools’ mechanism. This strategy offers a novel approach to liquidity and incentives, rewarding providers with a boosted APR for contributing liquidity to the Master pool.

As part of this new system, we propose an experimental 80:20 split for CMDX rewards, with the ‘boosted’ pool receiving approximately 80% of the total CMDX incentives for the phase. The remaining 20% will be equally divided amongst the other pools.

Insights into the Boosted Pool Mechanism:

cSwap DEX has reimagined the previous ‘Master Pool’ and ‘Child Pool’ structure to establish a more user-friendly ‘boosted pool’ mechanism.

Under this new system, a liquidity provider can maximize their rewards by contributing liquidity to the boosted pool(master pool) and one or more of the other pools.

To read more about cSwap v2 and improvements read this blog: https://blog.comdex.one/cswap-v2-turbocharging-the-defi-landscape-3f66b0de97d7

The breakup of rewards for each pool is as follows: