Important Update:

Transitioning to a new framework, all pools will now receive base CMDX rewards, with CMDX pairs given priority. Currently, Harbor emissions have been paused.

Overview

cSwap v2 has been launched on the Mainnet, and an optimized incentive plan has been introduced to support the DEX’s growth and better align with user requirements

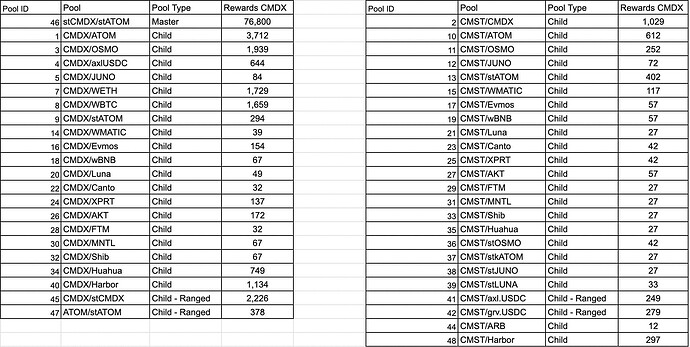

Our revised plan proposes allocating 96,000 CMDX for a period of 14 days.

The distribution of these rewards will commence once the current reward phase concludes.

In response to feedback that the Master/Child pool concept was difficult to grasp, we’ve adopted a simplified ‘boosted pools’ mechanism. This strategy offers a novel approach to liquidity and incentives, rewarding providers with a boosted APR for contributing liquidity to the Master pool.

The system allocates CMDX rewards using an 80:20 split, directing approximately 80% of the total CMDX incentives for the ‘boosted’ pool, while evenly distributing the remaining 20% among the other pools.

Insights into the Boosted Pool Mechanism:

cSwap DEX has reimagined the previous ‘Master Pool’ and ‘Child Pool’ structure to establish a more user-friendly ‘boosted pool’ mechanism.

Under this new system, a liquidity provider can maximize their rewards by contributing liquidity to the boosted pool(master pool) and one or more other pools.

To read more about cSwap v2 and improvements read this blog: https://blog.comdex.one/cswap-v2-turbocharging-the-defi-landscape-3f66b0de97d7

The breakup of rewards for each pool is as follows: