Liquidity farming: The Problem

Every protocol faces this problem while bootstrapping liquidity; to incentivize early liquidity, a protocol needs to distribute way more tokens for users to be early liquidity providers.

This is a way where a protocol distributes its tokens for a part of the liquidity the user has provided. When a protocol is new, a lot of tokens are distributed; that is how the current system works to attract liquidity.

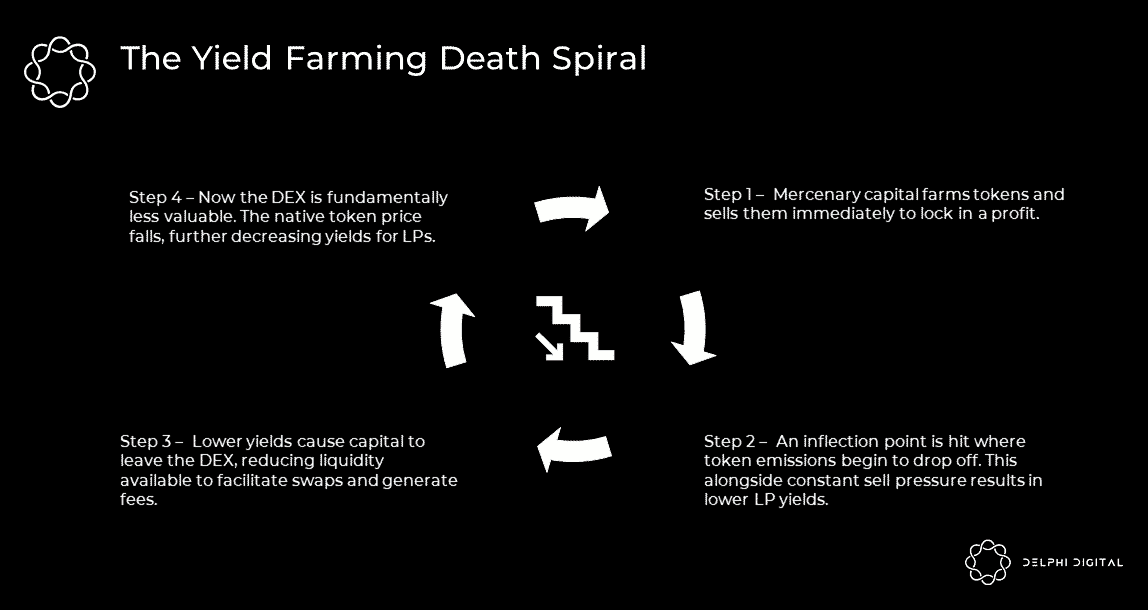

When the protocol distributes large amounts of tokens, the apparent thing users, who get free tokens, do is - sell those tokens. Hence the token price is dumped, and the liquidity that a protocol gains comes at the price of the token dump. Many failed yield farming schemes have blown up due to unsustainable token emissions.

The liquidity would only stay until a certain tipping point where the users feel that the rewards they are getting are optimal, and then the liquidity starts to vanish as rewards decrease, resulting in the loss of the user base gradually. This is the case with the 2020 DeFi summer, where users/liquidity jumped from protocol to protocol, searching for higher yields. There was no long-term incentive for users to stay and provide liquidity.

Here’s an excellent example of the flywheel effects of the liquidity farming death spiral:

Reference: https://members.delphidigital.io/reports/an-alternative-implementation-of-vetoken-economics

The solution that Curve Finance came up with to incentivize long-term participants:

One such model that encourages longer-term liquidity and is an optimal design that aims to dilute mercenary capital and speculators while rewarding value additive and long-term oriented participants is the vote-escrowed implementation introduced by Curve Finance. This model allows CRV holders to lock up their tokens as vote-escrowed CRV (veCRV) for up to 4 years. The longer a user locks their CRV, the more veCRV they receive.

In exchange for taking on liquidity risk and removing CRV supply from the market (showing their long-term commitment to the platform), veCRV holders are entitled to three main benefits:

- A pro-rated share of fees generated by Curve.

- Boosted CRV rewards on liquidity provider positions (up to 2.5x).

- Governance and gauge weight voting power. Importantly, the gauge weight dictates how Curve’s future emissions are distributed.

The above set of incentives generates a positive flywheel. The more long-term oriented a user is (measured by their veCRV), the more rewards they receive.

The veToken model avoids this by aligning liquidity providers with the long-term interest of the protocol.

For liquidity providers on Curve to capture the 2.5x boost on their rewards, they must hold a certain amount of veCRV relative to their liquidity. This incentivizes LPs not to dump tokens but instead:

- Purchase a position of CRV on the open market and lock it.

- Lock part or all of the CRV they receive as rewards for providing liquidity.

In turn, this encourages liquidity providers on the Curve platform to become long-term stakeholders and supporters of Curve’s success – as opposed to employing mercenary farm-and-dump strategies.

The problem with veCRV:

- veCRV is an illiquid token that cannot be transferred and has less utility, it can be used for governance and directing incentives to specific pools.

- The lockup works by reducing sell pressure and aligns for longer-term liquidity provisioning, but the opportunity costs in a dynamic environment like crypto are immense and where a four-year lock would discourage buying the token in the first place.

What if we give utility to the veCRV token and turn the token into an LP-staked position instead?

- The veCRV is a single token but imagine if veCRV is not a single token, but it’s an LP token that represents a liquidity position in a pool.

- Here, the token is not illiquid and is being used by traders as it’s a staked liquidity position.

- This is exactly what Osmosis is doing with the locking liquidity gauges. Still, the same problem of

yields going down and then the same death spiral is applicable here with Osmosis, where once the incentives go down, the liquidity would leave in search of better yield elsewhere.

The proposed incentive concept of Comdex:

As the token is distributed in exchange for the liquidity that a user provides, we can devise a way of telling the user that if you want to earn the maximum rewards and get the most tokens, you must have to provide some kind of assurance/collateral in the token that is being rewarded.

This concept can be used by any protocol that wants to incentivize its users, whether a yield aggregator, AMM, Borrow/Lending platform, or wherever incentives are needed to be distributed.

As the token would be airdropped, people will be incentivized not to sell but provide liquidity and farm more tokens and compound their positions. They require not to buy the token from the open market.

The incentives are directly proportional to the liquidity provided in that incentive token pool.

For example: Let’s call the incentive token $XYZ, so a user must provide liquidity in the $XYZ/$CMDX pool to maximize their rewards on other protocol-wide pools.

In this way, it would be in the user’s interest not to dump the incentive token because that would directly impact their LP in the $XYZ/$CMDX pool.

Liquidity Mining Rewards:

The $XYZ token provides liquidity mining rewards to the LPs on the DEX. If the tokens are solely used for rewards, they would lead to dump because there is no other use case. So we can keep this token as a central point where anyone who wants to maximize their yield would need exposure to this token.

The easiest way to do it is to get the token locked for weeks to months and provide liquidity mining rewards on the other pools based on their locked timeframe in the incentive token pool

The core pool, or call it the master pool that is currently the $CMDX/$XYZ pool, is the pool whose liquidity is taken into consideration for incentive distribution. Users can lock liquidity for a longer timeframe and earn mining rewards proportional to their share in the pool and the timeframe they have locked liquidity. This would make this pool the centre of liquidity and lock a lot of $CMDX for the DEX.

It has a few advantages over VE locking:

- Here, as the two tokens are pooled together, it creates a supply shock and utility for both tokens.

- The VE locked tokens would just be used to direct votes but now, as pool liquidity is locked, people can trade on it.

- A user would be able to remove the liquidity earlier from the pool but would be charged with penalties, and these penalties can then be used to reward the LPs in the pool.

- The yield farming death spiral can be controlled as a user is equally exposed to the reward token pool as to the other pool, for example, the $CMDX/$ATOM pool, so there are no free tokens that the user is farming.

They are farming at the expense of their liquidity in the $XYZ/$CMDX pool, and dumping the pooled tokens would only cause the value of his LP position in the $XYZ/$CMDX pool to drop, so rather than dumping the token, he can compound it and increase liquidity in the pools.

The rewards that they receive may it be APYs or any sort of incentives, depend on two propositions :

- Amount of liquidity locked in the $XYZ/$CMDX pool

- Time for which the liquidity is locked ideally from 2 weeks to 12 weeks, rather than years in the curve model

Here, the concept of VE locking for long-term liquidity provisioning and governance benefits combines the concept of time locking in a user-friendly way, and users can deploy capital in a specific way to their strategies.

The LPs of this pool would also be able to direct incentives to certain pools just like the veCRV holders - the pool liquidity providers may act as meta governance of the dex.

In a way, people locking for longer periods of time in the master pool are true long-term investors and believers of the protocol and token & most rewards should be directed to them rather than mercenary capital who have a short-term farm and dump intentions rather than true long-term supporters.

As all the pools would have the $CMDX pair as a second base pair, this would lead to a supply shock for the $CMDX token as well as keep the $XYZ token a central token that directs incentives.

We would love to hear the opinion of the community

Two good articles to read on VE tokenomics and its alternatives that have similar ideas :

-

Tokenomics Musings: ve tokens and alternatives by 0xKepler: Tokenomics Musings: ve tokens and alternatives — 0xKepler 🔭

-

An Alternative Implementation of veToken Delphi digital: https://members.delphidigital.io/reports/an-alternative-implementation-of-vetoken-economics