Title: cSwap Incentives Update: Introducing a Refined and User-Friendly Reward Distribution Model

Introduction:

In alignment with our vision as stated in “The Renaissance: Comdex’s odyssey back to its roots,” which mentioned that our current dApps will be improved upon, we are taking the first step in this series of enhancements with cSwap, We are concluding our current reward phase, having completed 42 phases.

With cSwap our mission is to enhance our platform’s functionality and user experience and offer users the easiest way to swap between any assets. In line with this commitment, we’re excited to present an update to the cSwap reward distribution model, designed to make it more intuitive and effective for all our users.

Reflection on the Current System:

Our current ‘boosted pools’ mechanism in cSwap v2 was a leap forward in optimizing liquidity incentives. However, we recognize the potential for further refinement to make our platform even more user-friendly.

In our effort to enhance the cSwap, we propose a series of strategic enhancements to our rewards system. A key aspect of this evolution is the transition away from the Boosted Pool Concept. This change is geared towards simplifying the reward structure, making the distribution process more straightforward and user-friendly. In addition, we aim to implement a more efficient reward system through a proportional incentive distribution, which will be based on the liquidity of each pool. This method ensures that incentives are distributed fairly and proportionally, reflecting the actual liquidity contribution of each pool. The final key enhancement involves a strategic reduction of incentives on pairs with lower liquidity. This approach is designed to optimize resource allocation and the effectiveness of our incentives, focusing them on pools that significantly contribute to the liquidity.

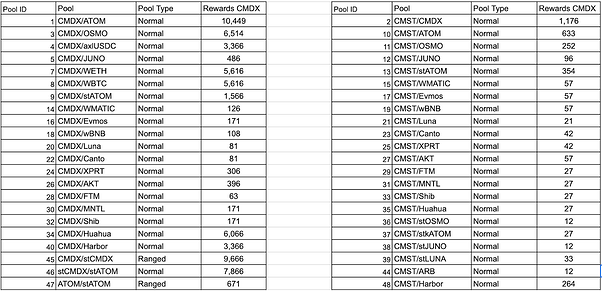

Our revised plan proposes allocating 66,234 CMDX for a period of 14 days.

The distribution of these rewards will commence once the current reward phase concludes.

The breakup of rewards for each pool is as follows:

Your perspectives and feedback are vital in shaping the future of cSwap. We encourage you to share your views on these proposed changes.

As we move forward, we will continue to enhance our platform and incorporate community feedback, ensuring that our evolution aligns with the needs and aspirations of our valued users.