The Renaissance: Comdex’s odyssey back to its roots.

Dear Comdex Community,

We embarked on our journey as builders in 2019, driven by a vision to revolutionise global finance. Our goal was to capture the largest financing market, supply-chain financing, and bring it on-chain. Along this journey, we encountered several challenges, achieved several milestones, and learned several lessons, all of which have today brought us to a point of synergistic convergence, ushering us into the next phase of our journey- the renaissance of RWA financing on chain.

We are happy to now provide you an overview of the next steps in our journey as builders as we approach the point of convergence in all that we’ve built so far to create ShipFi, the RWA hub of the interchain. After in-depth introspection and analysis of our successes and setbacks, we have formulated a multi-phase blueprint.

Over the course of this post, we will outline the following:

- Our origins and the thesis that Comdex was built on

- Our learnings building for CeFi

- Our journey building for DeFi

- The Blueprint for ShipFi

- Our Approach

Our origin

Our vision for creating Comdex was grounded in the belief that blockchain technology’s ultimate application lies in revolutionizing global supply-chain finance. We initially focused on trade finance, a significant sector in the world of finance, identifying substantial opportunities to address its inefficiencies and complexities.

To achieve this, we developed the Comdex Enterprise Trading platform, designed to greatly enhance global enterprises’ access to financing and reduce associated costs. At its launch, the platform offered functionalities to:

- Perform on-chain KYC/AML verification for onboarded parties.

- Tokenize a diverse range of assets as on-chain NFTs.

- Manage end-to-end trade workflows.

These capabilities were intended to lay the groundwork for a democratized RWA financing economy, facilitating on-chain settlements and financing. The platform successfully onboarded 18 institutional clients and managed workflows for over $160 million in commodity assets.

In the process of developing the platform, we conducted the first-ever non-standard IBC transaction by settling a trade of an RWA-NFT against fiat-backed tokens. (For more information, see this article)). By 2020, we had collaborated with Western Union to create a POC for this fiat-backed stable token, which we envisioned as the primary settlement method for platform users. The achievements we had attained up to this point reinforced our belief and commitment to our original thesis: bringing RWA financing on-chain.

Our learnings from building for CeFi

Achieving a comprehensive on-chain financing protocol required infrastructure capable of supporting the tokenization, transaction, collateralization, exchange, lending, and borrowing of assets, which was not readily available when we started. Therefore, we prioritised building an infrastructure layer before focusing on the application layer. Consequently, the Comdex chain was launched in 2021, initially serving as a DeFi infrastructure layer intended to eventually support and house financing economies.

The challenges posed by the lack of suitable infrastructure were compounded by the absence of a clear and favourable regulatory framework for institutional adoption of blockchain assets in business. With global economies reeling from the Covid pandemic, regulators and institutions increasingly took defensive measures to minimise their balance sheets’ exposure to high-risk digital assets.

From these challenges, we learned that:

- A robust, application-specific infrastructure layer is essential for developing an on-chain financing economy. In the absence of existing infrastructures, building our own was imperative.

- On-chain assets were still perceived as risky and lacked suitable regulatory frameworks for institutional handling and transactions. The absence of clear and favourable regulations would continue to limit adoption levels.

- Our original thesis about the significant potential for disruption in trade finance was correct but ahead of its time.

Our journey building DeFi

In response to evolving market conditions, we continued on our original path by launching the Comdex chain as an interchain DeFi infrastructure layer. This infrastructure supports the tokenization, transaction, collateralization, exchange, creation of synthetic assets, lending, and borrowing of on-chain assets. Utilizing this, we developed a base-layer DeFi money market to demonstrate the utility and robustness of our infrastructure.

Harbor Protocol and Commodo leverage this infrastructure for valuing, collateralizing, lending, creating a synthetic asset and borrowing against on-chain assets. cSwap uses it to create asset swapping markets and manage liquidity. Although applied to IBC assets, the economy we established mirrors transaction structures common in RWA financing.

Our achievements in successfully launching Harbor, Commodo, and cSwap were paralleled by challenges, particularly when Harbor users experienced setbacks due to flaws in oracle design. As dedicated builders, we commit ourselves fully to each project, and the impact of these events has been profound. In response, we have taken several steps to strengthen the ecosystem and view every setback as a critical learning opportunity. It’s important to recognize that not all DeFi economies are immune to vulnerabilities. Many notable DeFi protocols have faced similar issues, emerging stronger and more resilient. We are determined to follow this path and remain fully committed to compensating users affected by these incidents. We ask for the community’s patience as we thoroughly address these matters.

Our immediate priority is to recover the losses of our users on Harbor and to restore $CMST to suitable levels of collateralization. This is vital for achieving our vision for ShipFi.

The blueprint for ShipFi

As we move into 2024, we are refocusing on our core mission to build the hub of RWA-financing and revolutionise global finance. Since our inception, infrastructural and regulatory landscapes have evolved favourably towards blockchain technology. Institutions are now more receptive to holding and transacting in digital assets. However, the global trade financing gap has widened to $2.5 trillion, up from $1.5 trillion when we started, with SMEs facing credit costs almost 15 times higher than larger enterprises, despite having default rates below 2%.

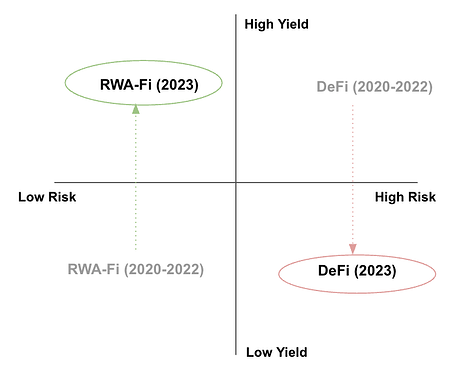

Furthermore, the global macroeconomic climate has shifted such that the yields from low-risk RWAs now compete with those from high-risk DeFi protocols. RWAs offer a significantly lower risk for comparable or higher yields, appealing to on-chain liquidity seeking safer yield opportunities.

What is ShipFi?

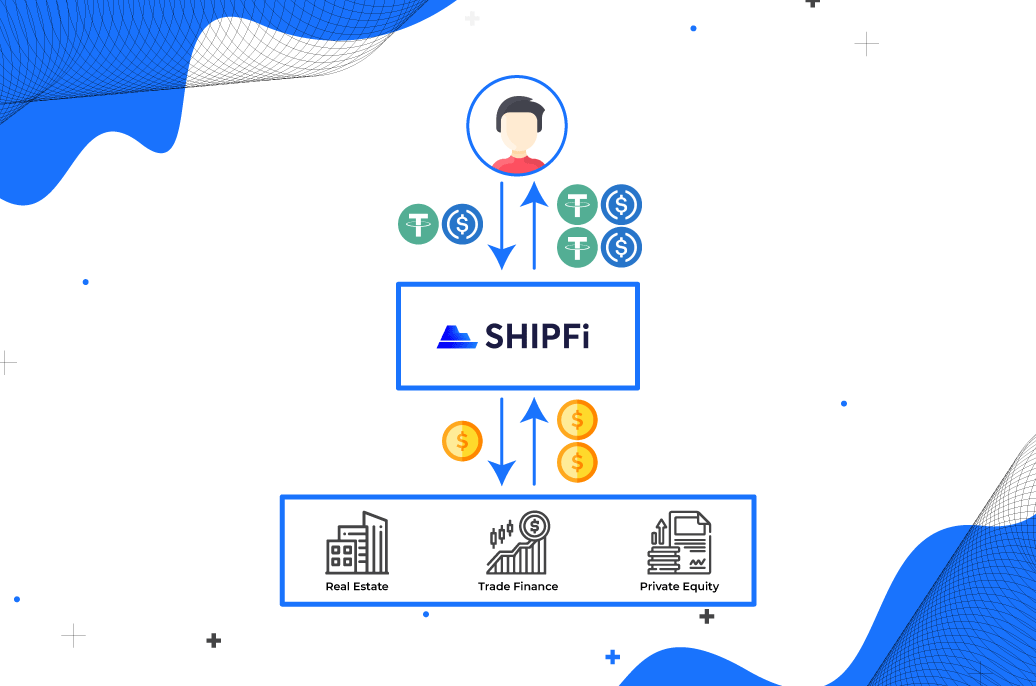

First introduced in 2021, ShipFi is an interchain RWA-financing hub designed to enhance the efficiency and transparency of global financing markets. It operates on two fundamental pillars: on-chain settlements and financing. Enterprises using ShipFi can conduct and settle trades on-chain through our settlement engine. Borrowers can collateralize tokenized RWAs, like invoices and mortgages, to access stablecoin liquidity at competitive rates. Stablecoin holders can contribute to these fully-collateralized pools, lending liquidity with full legal recourse.

ShipFi ambitiously aims to tap into over $1.5 trillion of credit financing market volumes on-chain. The platform will generate revenue from:

- Settlement fees (%)

- New loan financing fees (%)

- Investment/Redemption fees ($)

- Repayment fees ($)

- Underwriter fees ($)

All revenues on ShipFi will be in stablecoins. Contrary to initial announcements, ShipFi will not launch with a native token. Instead, a portion of the revenue will be allocated to buy-and-burn CMDX, with the remainder funding a DAO-controlled treasury wallet. This ensures that CMDX holders and stakers earn maximum value from growing adoption on ShipFi.

Our Approach

We are extremely excited and optimistic about the future of RWA-financing on-chain. As we embark on this next phase, it’s crucial to outline our team’s approach and focus areas.

Plan with Existing Comdex dApps

The recovery of $CMST is a vital component of the RWA financing framework, and thus remains our top priority. We are fully committed to collaborating with stakeholders to support affected CMST users and will announce a detailed plan of action after thorough exploration of all avenues. Following its restoration, the Harbor protocol will be streamlined to allow CMST minting exclusively with ATOM, stATOM, and stablecoins from stablemint. Our ongoing efforts will be directed towards enhancing capital efficiency and security.

Harbor x ShipFi

The Harbor protocol and ShipFi are inherently synergistic. Harbor is built to provide liquidity in CMST to the interchain & maintain security through diversity of its collateral base. ShipFi is built to be an interchain hub for RWA origination, payments and financing. A growing adoption base for ShipFi inherently implies growth for CMDX, Harbor protocol and CMST. CMST will be utilised on ShipFi as a means for payment settlements and financing. Additionally, a long-term objective for both dApps is to use ShipFi’s RWAs as collateral for minting CMST, boosting CMST adoption and adding value to the entire Comdex ecosystem. This would further benefit Harbor protocol in diversifying CMST’s collateral base with the addition of RWAs.

Team Focus

With essential infrastructure in place, the Comdex team is now focusing on developing ShipFi, striving to establish Comdex as a leading interchain RWA-DeFi hub. Success hinges on creating an effective payment settlements and financing system. While the team concentrates on ShipFi, the community development fund will continue to award grants, encouraging the creation of products complementary to the Comdex ecosystem.

Additionally, we are dedicated to continuously researching and implementing tokenomics improvements to ensure CMDX stakers benefit from network growth.

In the coming days, we will release a comprehensive overview of the ShipFi app, including its roadmap and timelines. We acknowledge the importance of open communication between teams and the community and are committed to fostering greater community involvement moving forward.

We recognize the challenges faced by the Comdex community in recent months and are dedicated to building Comdex into the vision it was always meant to achieve.