Hi Community

We appreciate your positive response and your valuable questions. Addressing your inquiries first:

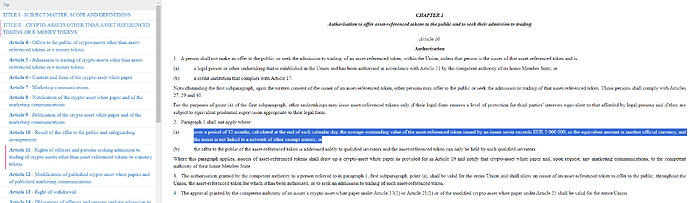

Classification as a Security: We believe that the following passage from the MICA law is protecting us, as long as we promote decentralization, and keep SPV granularity under approx. 5M$ each.

I would say that it is very reasonable size from EU law perspective and for COMDEX too. Please see attached screen shot from MICA Law:

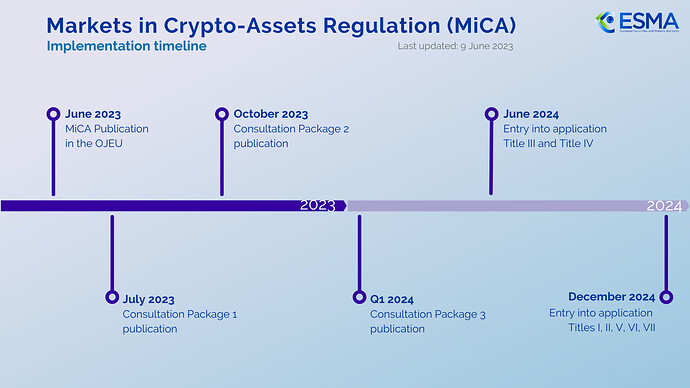

Time Plan for Next Steps: As we delve into the exciting prospect of integrating Special Purpose Vehicles (SPVs) into the Comdex ecosystem, we find ourselves at a remarkable juncture. The impending timeline set by the Markets in Crypto-Assets Regulation (MICA), with the approval of Title III and IV slated for June 2024, presents us with a unique and time-sensitive opportunity.:

Under the provisions of MICA, we observe that SPVs can operate without the extensive regulatory requirements if certain conditions are met. One such condition is that over a 12-month period, the average outstanding value of the asset-referenced token issued by an issuer must not exceed EUR 5,000,000, or the equivalent amount in another official currency. Moreover, the issuer should not be linked to a network of other exempt issuers.

This specific condition aligns seamlessly with our vision. It opens the door for us to birth SPVs within the Comdex ecosystem, capitalizing on the simplified regulatory framework envisioned by MICA. By staying below the EUR 5,000,000 threshold, we not only streamline our journey but also pave the way for agile and efficient SPV operation.

This opportunity is akin to setting sail on uncharted waters. It allows Comdex to become a pioneer in harnessing the potential of Real Commodities SPVs with it’s unique “Due Diligence on Chain”, unleashing their capabilities to empower our community. As we navigate through this regulatory landscape, we could poised to revolutionize the Comdex ecosystem.

Thinking about what would be the MVP for such Pilot:

-

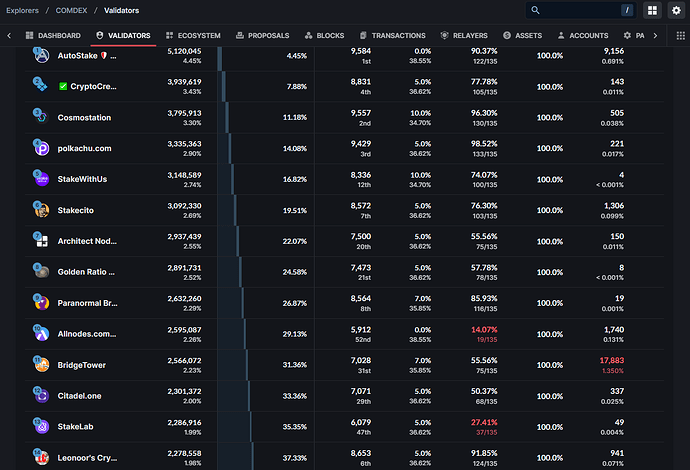

Independent Node running in name of the first SPV. What is the community recommendation for us ? Should we use white labeled outsourced node, or we should do it differently ? Do you have any preferences from community perspective ? I would also like to recognize that we noticed that you Leonoors Crypto, you are running successful node. What would be your own recommendation for the group ? I guess we need to think about management of this node already via multi-sig wallet that is in hands of BOARD of SPV. What is your recommendation as a solution ?

-

We would need a great design for RE Development UI , connected to on-chain governance on COMDEX. What is the best approach ? The concept revolves around creating a seamless and transparent due diligence process for real estate development projects within the Comdex ecosystem (following generic RE development process adapted to our needs). It aims to ensure that the community has control over the financing of these projects while safeguarding their interests.

Key Features & some early questions that you might want to help with:

Resumen

- User-Friendly Dashboard:

The SPV NODE web UI should have an intuitive COMDEX node dashboard that allows users to easily understand NODE DATA and relay them to the SPV native assets that are minted (e.g. debt or equities). Among SPV assets we can see CMDX holdings as well as all other node parameters, but also there are appropriate links to navigate through different stages of the RE development process related to the assets (the same due diligence process leveraged by Community). Users can track project progress, approvals, and financial details provided directly by the node. Decision to stake might come from that angle.

- Blockchain Integration:

We need to keep RE project-related data in a wide sense. Could we store them together with NODE / VAULT ? Do we have a standard place to keep Project Data tied to the Node or Vault ?

Due Diligence approvals and status of due diligence elements (checklist). We understand that this would work via COMDEX governance, but can we easily access these type of on-chain data and present them on the UI ? What are the current best technics to access on-chain data via query, in order to fetch dispersed data across subsequent blocks data from COSMOS type blockchain ?

Allocation of the waves of cleared assets (Capital Stack 1) to the ODIS holders.

- Capital Stack 1 Debt:

This represents the foundational funding for real estate projects. From the SPV Node UI Delegators can monitor “SPV capital stack 1 debt” issued by SPV in the context of the total ODIS accruals issued by the system in form of ODIS fungible token that gives access to white listed assets. The SPV debt is issued by given SPVs as non-fungible in nature token (pegged to the unique asset) that consume ODIS balance once authorized by due diligence process. In this scenario fungible ODIS accrual tokens are just a vehicle to manage an excess of interest by the public in form of staking CMDX to our node. The ODIS accruals could be automatically allocated to whitelisted assets following FIFO to people who are staking with the SPV node. The CUPONS of these contracts could follow FIFO chronological settlement calendars and could be paid by the SPV Node accordingly to the user wallet who owned ODIS (smart contract).

We would likely require contract running on chain to protect 5M$ compliance requirement:

*"Over a period of 12 months, calculated at the end of each calendar day, the average outstanding value of the ODIS asset-referenced tokens (debt capital stack 1 + value of equities (not minted yet at genesis) can never exceeds 5M EUR, or the equivalent amount in another official currency (we would likely select $)" .

We could start minting of ODIS as new delegators are staking CMDX on this node. Is this something that would need to be approved as a Protocol upgrade ? How this works ?). It will be likely fair to assume that staking on this particular node has a significance of promoting the project and allowing ODIS to be issued (locked) in the first place. We need to introduce that rule of 5M$.

We think we could easily design minting formula that slows down minting as we are approaching the limits.

- Unlocking Mechanism: The unlocking of ODIS-Assets-Referenced tokens (non-fungible) is directly tied to on-chain governance approvals. For example, when the community reaches a consensus to approve a specific chunk of development project, a portion of ODIS coins held by people can be now swap for Assets-Referenced coins.

Community Get-Togethers: In line with our commitment to transparency and inclusivity, organizing community get-togethers or virtual meetings is an excellent idea. We would start simple, let’s make 1h brain storming session to discuss what is possible, what do you think ? This could evolve in 1h weekly working session with few individuals that feels it is good idea and want to participate. We could decide to record the sessions to use it for future material for marketing. These gatherings can serve as platforms for detailed discussions, brainstorming, and sharing insights. They could be organized in topics as suggested on the list. This would enable us to collectively address concerns, fine-tune strategies, and ensure that all stakeholders are informed and engaged throughout the process. We believe that community involvement is vital for the success of this endeavor, and such gatherings can facilitate meaningful participation.

Time-Wise Plans: Time management is crucial, especially when dealing with a multifaceted project like this one. We intend to develop with you a detailed project plan outlining key milestones, deadlines, and dependencies for each phase. This will ensure that everyone involved, including the Comdex community, validators, and SPVs, is aware of what needs to be accomplished and by when. Flexibility will be built into the plan to adapt to changing circumstances and regulatory developments.

Your questions and feedback are invaluable. Please be so kind and provide your best answers to few questions presented above. Please let us also know if we could organize 1h Zoom Kick-Off session.

We look forward to further discussions and planning.

Best regards,

DAODISEO